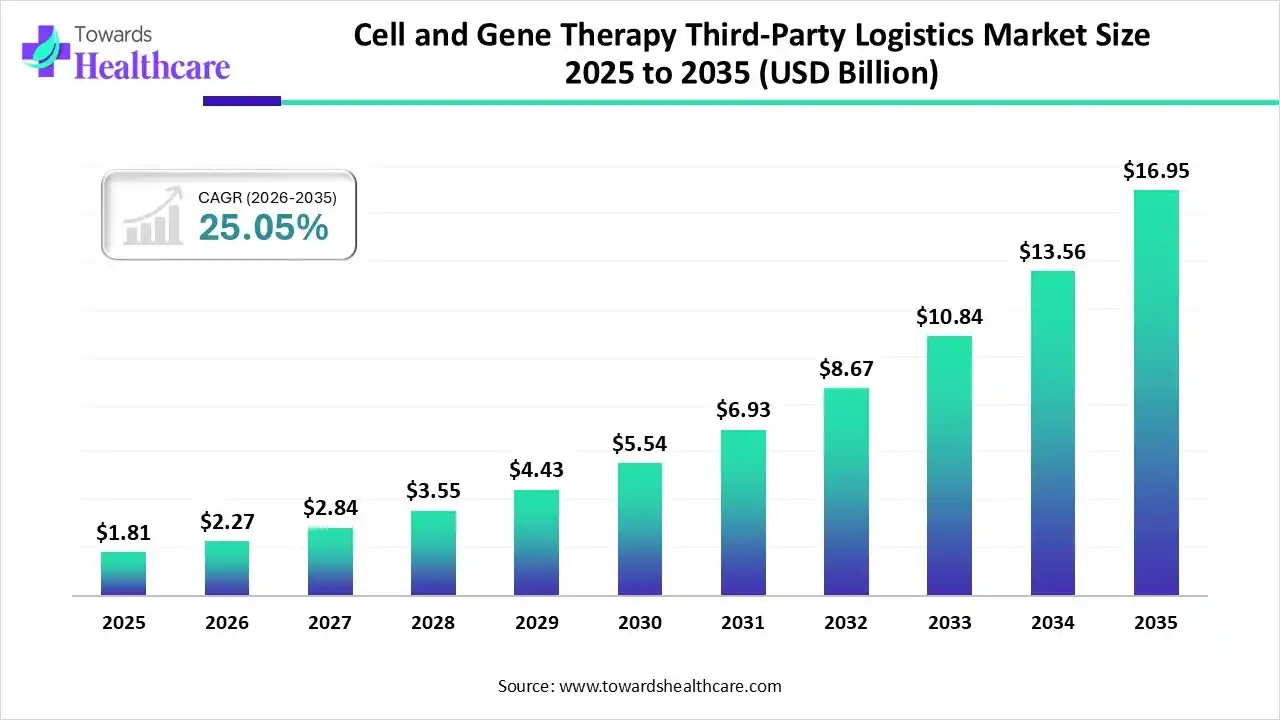

Cell and Gene Therapy Third-Party Logistics Market Forecast From USD 1.81 Billion in 2025 to USD 16.95 Billion by 2035 Drives by Personalized Medicine Growth

The global cell and gene therapy third-party logistics market size was valued at USD 1.81 billion in 2025 and is predicted to hit around USD 16.95 billion by 2035, rising at a 25.05% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 07, 2026 (GLOBE NEWSWIRE) -- The global cell and gene therapy third-party logistics market size is calculated at USD 2.27 billion in 2026 and is expected to reach around USD 16.95 billion by 2035, growing at a CAGR of 25.05% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5574

Key Takeaways

- The cell and gene therapy third-party logistics sector pushed the market to USD 2.27 billion by 2026.

- Long-term projections show a USD 16.95 billion valuation by 2035.

- Growth is expected at a steady CAGR of 25.05% in between 2026 to 2035.

- North America was dominant in the market in 2024.

- Asia Pacific is expected to be the fastest-growing region during 2025-2034.

- By type, the clinical segment led the cell and gene therapy third-party logistics market in 2024.

- By type, the commercial segment is expected to witness rapid expansion in the upcoming years.

- By product, the cell therapies segment dominated the market in 2024.

- By product, the gene therapies segment is expected to grow at a rapid CAGR in the studied years.

- By temperature range, the ambient storage segment held the largest share of the market in 2024.

- By temperature range, the refrigerated storage segment is expected to grow fastest during 2025-2034.

- By end-use, the biopharmaceutical companies segment was dominant in the market in 2024.

- By end-use, the CDMOs/CMOs segment is expected to be the fastest-growing in the coming years.

What are the Emerging Developments in the Cell and Gene Therapy Third-Party Logistics?

The cell and gene therapy third-party logistics market covers many specialized companies that handle the highly complex, patient-centric supply chain for delicate, live biological therapies, which further need temperature control, real-time monitoring, secure storage, and time-critical transport from manufacturing to patients. The global expansion of this market is fueled by increasing tailored medicine, clinical trials/approvals and other technological innovations, mainly in ultra-cold chain logistics. Recently, DHL acquired CryoPDP to accelerate its ultra-low temperature logistics for life sciences, enhancing cold chain capabilities.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Key Drivers in the Cell and Gene Therapy Third-Party Logistics Market?

Along with the rising demand for precision medicine, the market is propelled by progressing CGT research and regulatory approvals for novel therapies, which highly demands specialized logistics. Furthermore, major and stricter regulatory compliances, such as FDA, GMP, and GDP, mandate the need for strict cold chain management and quality control, and further favors specialized 3PLs. Numerous biopharma companies are dependent on expert 3PLs to handle complex logistics, reducing risk and ensuring quality.

Trends in the Cell and Gene Therapy Third-Party Logistics Market

- In December 2025, SCTbio and Fortrea made a strategic collaboration agreement between the two companies to simplify development, accelerate timelines and execute advanced therapies to patients rapidly.

- In December 2025, ENCell signed a memorandum of understanding (MOU) with Cell Therapies, CGT CDMO, to widen access to CGT development and manufacturing in the Asia-Pacific (APAC) region.

What is the Developing Challenge in the Market?

Specifically, higher temperature/time sensitivity, complex autologous supply chains (patient-specific), stricter regulatory obstacles, needing specialised 3PLs for cold chain, real-time tracking, and customs are creating major barriers in the cell and gene therapy third-party logistics market.

Regional Analysis

Why did North America Dominate the Market in 2024?

By capturing a dominant share, North America led the market in 2024. A prominent catalyst is strict guidelines from the FDA and adherence to Good Distribution Practices (GDP) mandate advanced storage and transportation protocols. Alongside, the region is encouraging the progression of cold chain capabilities, such as UPS Healthcare, which expanded its cold chain infrastructure in Louisville, Kentucky, with the emergence of innovative freezer farm and latest temperature monitoring technologies to assist the distribution of temperature-sensitive biologics and vaccines.

For instance,

- In October 2025, Frontier Scientific Solutions, a contract service organization (CSO), and Air Transport Services Group partnered to accelerate the delivery process surrounding temperature-controlled pharmaceuticals.

Why did the Asia Pacific Grow Significantly in the Market in 2024?

In the coming era, the Asia Pacific is anticipated to expand rapidly in the cell and gene therapy third-party logistics market. Ongoing biotech investments, particularly in China, Japan, India, and a rise in the pipeline of therapies, are increasingly demanding specialised cold-chain logistics and stringent quality control. Whereas China is immensely investing in temperature-controlled warehouses, ultra-low temperature storage, like -70°C and -196°C for biosamples and products, and express cold-chain transportation infrastructure to complete the increasing demand and strict government regulations.

For instance,

- In June 2025, Porton Advanced Solutions collaborated with Egypt-based EVA Pharma to develop and boost chimeric antigen receptor (CAR) T-cell therapy development and manufacturing capabilities, using EVA Pharma's facilities in the Middle East & Africa.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Government Initiatives in the Respective Market in 2024-2025

| Medical Product Supply Chain Resilience (HHS) | Exploring a 2025–2028 Action Plan, especially focusing on addressing shortages and enhancing the resilience of medical product supply chains, mainly for pharmaceuticals and advanced biologics. |

| BioSecure Act of 2024 | This is emphasized restrict U.S. collaboration with specific Chinese biotech firms over genomic data issues, incentivizing a movement toward domestic and allied 3PL and CDMO partners. |

| Spanish MIA License Progression | In 2024, Spain’s medicine agency authorised Alcura (Cencora) a Manufacturing and Importation Authorization (MIA) license, to allow specialized import and storage services for commercial CGT products in the region. |

Segmental Insights

By type analysis

How did the Clinical Segment Lead the Market in 2024?

The clinical segment captured a major share of the cell and gene therapy third-party logistics market in 2024. Raised emphasis on patient-centric supply chains, handling limitations, and the expansion of cell/gene therapies for oncology, elevating the ned for strong networks for sample collection, distribution, and delivery. Specifically, 3PLs are providing more united services, from patient ID to data collection, assisting both autologous (circular) and allogeneic (linear) supply chains.

However, the commercial segment is anticipated to expand rapidly. Continuous rising demand for precision therapies, with spurring biotech R&D, and ongoing breakthroughs in cold chain, real-time monitoring, and tracking systems are bolstering the scalable, global distribution networks. Additionally, firms are leveraging scaling manufacturing by using AI, automation, and decentralized production for better access. Additionally, they are promoting innovative delivery systems like lipid nanoparticles (LNPs) and hydrogels with a focus on streamlining logistics.

By product analysis

Which Product Dominated the Cell and Gene Therapy Third-Party Logistics Market in 2024?

The cell therapies segment held the biggest share of the market in 2024. Specifically, autologous (patient's own cells) and allogeneic therapies need intricate, "vein-to-vein" supply chains with stricter temperature control. Currently, many companies are investing in cryogenic shippers, ultra-low temperature freezers, and specialized handling, with the development of logistics networks with facilities in the US & EU to support global access.

Furthermore, the gene therapies segment is predicted to witness rapid expansion. The globe is stepping towards patient-specific treatments for cancer, genetic disorders, and neurological conditions, with persistent innovations in viral vectors, such as CRISPR-based delivery and advanced cold chain tech (cryo-storage, ambient), supporting prospective gene therapy enhancement. Besides this, escalating R&D and approvals, like for haemophilia and cancers, require specialised networks for direct-to-patient and multi-site delivery.

By temperature range analysis

Why did the Ambient Storage Segment Dominate the Market in 2024?

In 2024, the ambient storage segment registered dominance in the cell and gene therapy third-party logistics market. Diverse gene therapies and advanced biologics are becoming more stable, which demands less extreme temperature control (2-8°C or ambient) than initial cryogenic requirements. Also, this kind of storage streamlines operations, lowers expenses and facilitates increased flexibility as compared to ultra-cold chains.

On the other hand, the refrigerated storage segment is anticipated to register the fastest growth. Prominently needed for live cells/viral vectors, which are highly temperature-sensitive, and require refrigerated (2-8°C) or cryogenic storage. For example, PROVENGE (sipuleucel-T), an autologous immunotherapy for prostate cancer, can be kept in the infusion bag at 2-8°C until infusion.

By end-use analysis

What Made the Biopharmaceutical Companies Segment Dominant the Market in 2024?

The biopharmaceutical companies segment held a major share of the market in 2024. Mainly, they are focusing on exploring integrated solutions to cover packaging, tracking, temperature control, and compliance for the complete journey from clinic to patient. An immerisve technological platforms, like Vineti & TrakCel, are managing and orchestrating the complex cell and gene therapy supply chain, from patient to treatment.

However, the CDMOs/CMOs segment is estimated to expand rapidly. Lonza, Thermo Fisher Scientific (Patheon), Catalent, Novartis (Cell & Gene Therapies), are providing CGT manufacturing, viral vector services, and logistics for autologous (patient-specific) & allogeneic therapies. Also, they are putting robust efforts into cell therapy development, manufacturing (CAR-T), and integrated supply chain solutions.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Key Developments in the Cell and Gene Therapy Third-Party Logistics Market

- In October 2025, Orsini, a leader in rare disease pharmacy solutions, launched its integrated specialty pharmacy and third-party logistics (3PL) solution, powered by the company's new Columbus, Ohio facility.

- In August 2025, Bionova Scientific, a full-service biologics contract development and manufacturing organisation (CDMO) and subsidiary of Asahi Kasei, unveiled a 10,000 square-foot plasmid DNA (pDNA) development and production facility in The Woodlands, Texas.

- In August 2025, Celcius Logistics launched Celcius+, a specialised logistics vertical that emphasised only the pharmaceutical supply chain.

- In January 2025, Cryoport, Inc., launched its Cryoport Express Cryogenic HV3 Shipping System ("HV3"), its newest comprehensive portfolio for transporting lifesaving biologics and temperature-sensitive therapies.

Browse More Insights of Towards Healthcare:

The global cell and gene therapy CRO market size is estimated at US$ 4.90 billion in 2024, is projected to grow to US$ 5.39 billion in 2025, and is expected to reach around US$ 12.59 billion by 2034. The market is projected to expand at a CAGR of 9.9% between 2025 and 2034.

The global cell and gene overexpression service market size is calculated at US$ 771.40 million in 2024, grew to US$ 805.73 million in 2025, and is projected to reach around US$ 1,192.24 million by 2034. The market is expanding at a CAGR of 4.45% between 2025 and 2034.

The global cell and gene therapy thawing equipment market size recorded US$ 0.96 billion in 2024, set to grow to US$ 1.1 billion in 2025 and projected to hit nearly US$ 3.56 billion by 2034, with a CAGR of 14.24% throughout the forecast timeline.

The global cell and gene therapy isolator market size is calculated at USD 1.35 billion in 2024, grew to USD 1.52 billion in 2025, and is projected to reach around USD 4.47 billion by 2034. The market is expanding at a CAGR of 12.54% between 2025 and 2034.

The global cell and gene therapy drug delivery devices market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global cell and gene supply chain solutions market size is calculated at US$ 3.54 billion in 2024, grew to US$ 4.09 billion in 2025, and is projected to reach around US$ 14.95 billion by 2034. The market is expanding at a CAGR of 15.54% between 2025 and 2034.

The cell and gene therapy infrastructure market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global cell and gene therapy tools and reagents market size is calculated at US$ 10.04 billion in 2024, grew to US$ 11.12 billion in 2025, and is projected to reach around US$ 27.3 billion by 2034. The market is expanding at a CAGR of 10.76% between 2025 and 2034.

The global cell and gene therapy manufacturing QC market size is calculated at USD 2.66 billion in 2024, grew to USD 3.11 billion in 2025, and is projected to reach around USD 12.35 billion by 2034. The market is expanding at a CAGR of 16.89% between 2025 and 2034.

The global cell and gene therapy (CGT) pharmaceuticals market size recorded US$ 16.75 billion in 2024, set to grow to US$ 19.91 billion in 2025 and projected to hit nearly US$ 91.56 billion by 2034, with a CAGR of 18.93% throughout the forecast timeline.

Cell and Gene Therapy Third-Party Logistics Market Key Players List

- Cencora Corporation

- Cardinal Health

- McKesson Corporation

- EVERSANA

- Knipper Health

- Arvato SE

- DHL

- FedEx

- Kuehne + Nagel

- United Parcel Service of America, Inc.

Segments Covered in the Report

By Type

- Clinical

- Commercial

By Product

- Cell Therapies

- Gene Therapies

By Temperature Range

- Ambient Storage

- Refrigerated Storage

- Ultra-Low Temperature Storage

- Cryogenic Storage

By Therapeutic Area

- Oncology

- Neurology

- Cardiovascular Diseases

- Ophthalmology

- Infectious Diseases

- Others

By End-use

- Biopharmaceutical Companies

- CDMOs/CMOs

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5574

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.