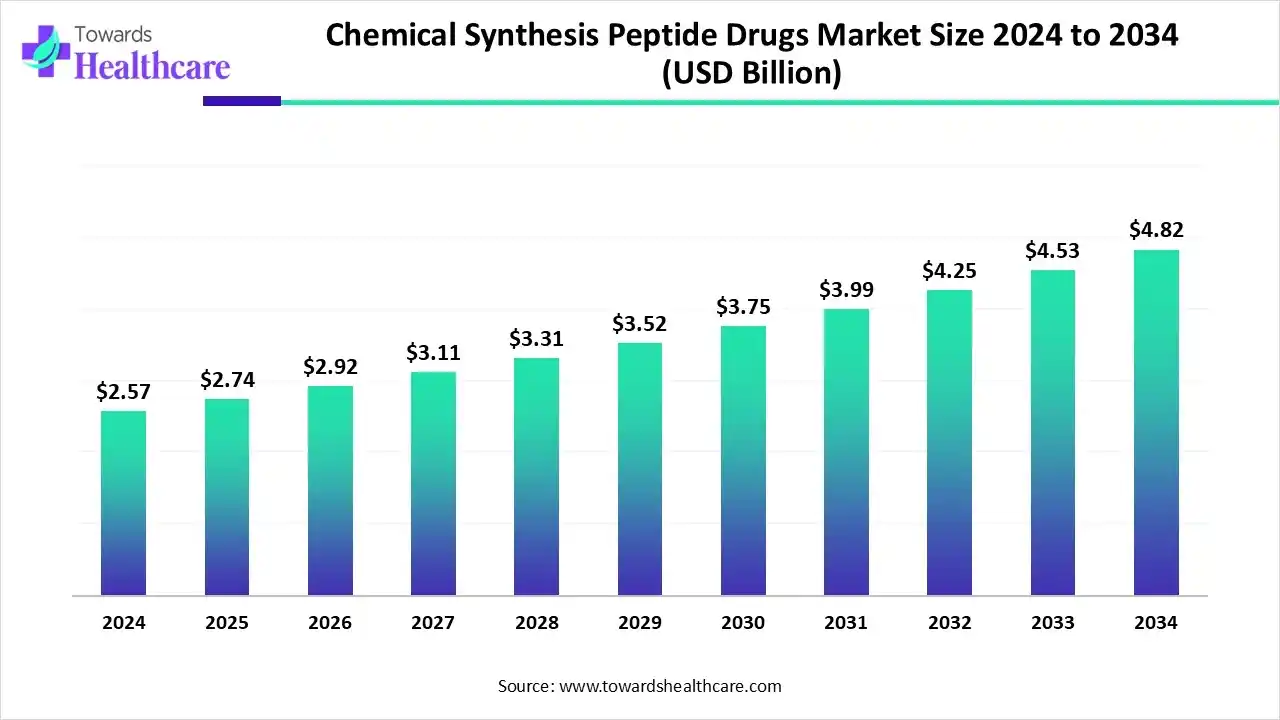

Chemical Synthesis Peptide Drugs Market Set to Reach USD 4.82 Billion by 2034, Growing at a 6.54% CAGR Driven by Automation and Green Chemistry Advances

The chemical synthesis peptide drugs market size was valued at USD 2.57 billion in 2024 and is predicted to hit around USD 4.82 billion by 2034, rising at a 6.54% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 16, 2025 (GLOBE NEWSWIRE) -- The global chemical synthesis peptide drugs market size is calculated at USD 2.74 billion in 2025 and is expected to reach around USD 4.82 billion by 2034, growing at a CAGR of 6.54% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6361

Key Takeaways

- The chemical synthesis peptide drugs sector pushed the market to USD 2.57 billion by 2024.

- Long-term projections show a USD 4.82 billion valuation by 2034.

- Growth is expected at a steady CAGR of 6.54% in between 2025 to 2034.

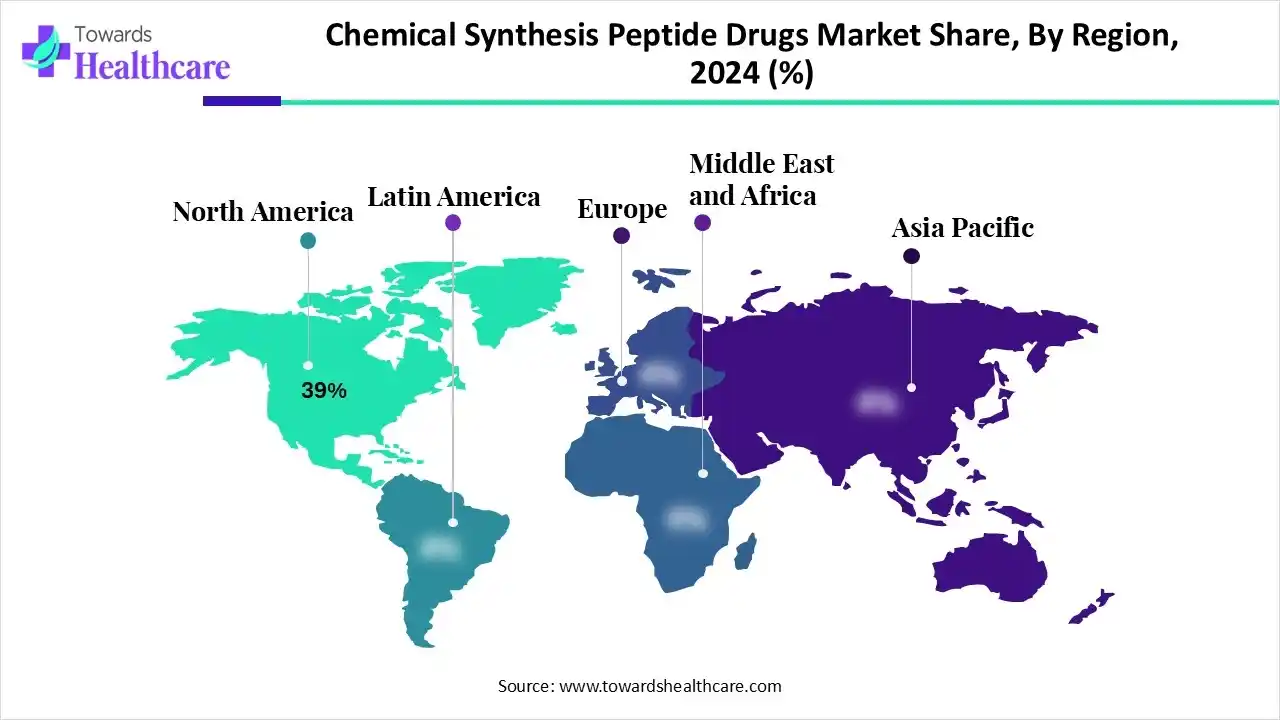

- North America accounted for the largest revenue share of the market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the studied years.

- By synthesis method, the chemical synthesis segment led the chemical synthesis peptide drugs market in 2024.

- By synthesis method, the non-chemical synthesis segment is expected to grow rapidly during 2025-2034.

- By synthesis technology, the solid-phase peptide synthesis (SPPS) segment was dominant in the market in 2024.

- By synthesis technology, the hybrid phase peptide synthesis segment is expected to grow at a rapid CAGR in the predicted timeframe.

- By product type, the reagents & consumables segment held the dominating share of the market in 2024.

- By product type, the services segment is expected to witness the fastest growth during the forecast period.

- By end-user, the pharmaceutical & biotechnology companies segment dominated the market in 2024.

- By end-user, the CDMOs/CROs segment is expected to grow fastest in the coming years.

- By application, the therapeutics segment led the market in 2024.

- By application, the diagnostics segment is expected to grow rapidly in the studied years.

What are the Ongoing Improvements in the Chemical Synthesis Peptide Drugs?

Firstly, the global chemical synthesis peptide drugs market covers those drugs produced from amino acids using methods such as Solid-Phase Peptide Synthesis (SPPS) or Liquid-Phase Peptide Synthesis (LPPS). The consistent expansion is propelled by the superior specificity/safety of peptides over small molecules, and the emergence of AI/automation pushing discovery. Nowadays, researchers are focusing on boosting stability (like cyclization, D-amino acids, chemical modifications), escalating delivery (such as oral forms with enhancers), and targeting specific diseases, and substantial developments in rare diseases (trofinetide for Rett Syndrome), pain, and infection (POL7080).

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Prominent Drivers in the Market?

Particular driver is the major benefit of peptides, like their greater specificity, potency, low toxicity, and good biocompatibility, are assist in developing a novel ideal candidate. Alongside, numerous biotech firms are increasingly investing in R&D spending and clinical trials for peptide therapeutics, which denotes promise in the industry. Along with this, various pharma companies are actively using specialized Contract Development & Manufacturing Organizations (CDMOs) for affordable, large-scale production, mainly in APAC.

What are the Key Trends in the Chemical Synthesis Peptide Drugs Market?

- In November 2025, Biogen Inc. and Dayra Therapeutics entered into a research collaboration to discover and evolve oral macrocyclic peptides for priority targets in immunological concerns.

- In October 2025, SK pharmteco, a global contract development and manufacturing organization (CDMO), invested $6.1 million in its Rancho Cordova facility to boost and equip a new lab and CGMP-Kilo-scale facility for Solid-Phase Peptide Synthesis (SPPS) and purification.

What is the Significant Limitation in the Market?

The global market is facing challenges in the higher spending of starting materials, complex multi-step processes, high solvent waste (Process Mass Intensity), and struggles in the synthesis of longer peptides (error accumulation, purification).

Executive Summary Table

| Table | Scope | |

| Market Size in 2025 | USD 2.74 Billion | |

| Projected Market Size in 2034 | USD 4.82 Billion | |

| CAGR (2025 - 2034) | 6.54 | % |

| Leading Region | North America by 39% | |

| Market Segmentation | By Synthesis Method, By Synthesis Technology, By Product Type, By End-User, By Application, By Region | |

| Top Key Players | Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Bristol-Myers Squibb (BMS), Merck & Co., Inc. (MSD), Amgen Inc., PolyPeptide Group, Bachem AG, Lonza Group Ltd., CordenPharma (part of Novacap/contract pharma group), AmbioPharm Inc., CPC Scientific / Chinese Peptide Company (CPC), ScinoPharm Taiwan Ltd., Peptide Institute, Inc., GenScript Biotech Corporation, JPT Peptide Technologies GmbH. | |

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

How did North America hold a Major Revenue Share of the Market in 2024?

In 2024, North America registered dominance in the chemical synthesis peptide drugs market by 39%. The regional market is fueled by a robust FDA support for rapid approvals of new peptide drugs, and a rise in demand for GLP-1 drugs, such as Ozempic/Trulicity, for diabetes/weight loss. In June 2025, the FDA-cleared liraglutide (Victoza/Saxenda formulations) for pediatric type 2 diabetes, with widening application areas for existing synthetic peptides.

For instance,

- In August 2025, Amphastar Pharmaceuticals signed an exclusive licence agreement with Nanjing Anji Biotechnology to raise the evolution, production, use and commercialisation of three peptides in the US and Canada.

How did the Asia Pacific Grow Notably in the Market in 2024?

During 2025-2034, the Asia Pacific is anticipated to expand at a significant CAGR in the chemical synthesis peptide drugs market. Specifically, China and India are facilitating affordability for peptide synthesis, with growth in geriatric populations and lifestyle changes rising demand for peptide drugs for diabetes, cancer, and metabolic disorders. Currently, Chinese researchers are working on bifunctional peptides targeting integrins (HM-3 and AP25) to accelerate anti-angiogenic and anti-proliferative effects against gastric cancer cells.

Few Examples of FDA-Approved Peptide Drugs in 2025

| Drugs | Indications |

| Yorvipath (Palopegteriparatide) | For hypoparathyroidism, administered subcutaneously. |

| Lumisight (Pegulicianine) | For detecting cancerous tissue during surgery. |

| Keytruda (Pembrolizumab) | For subcutaneous administration in diverse cancers. |

Segmental Insights

By synthesis method analysis

How did the Chemical Synthesis Segment Lead the Market in 2024?

In 2024, the chemical synthesis segment captured the biggest share of the chemical synthesis peptide drugs market. The widespread manufacturers are highly using solid-phase peptide synthesis (SPPS) and, for longer sequences, Native Chemical Ligation (NCL). The era is leveraging nanoparticles and liposomes to protect them from degradation and accelerate targeting to particular tissues.

The non-chemical synthesis segment is anticipated to register rapid expansion. This mainly comprises biological synthesis (recombinant DNA technology and fermentation) and chemoenzymatic peptide synthesis (CEPS). Whereas diverse solutions, including phage, yeast, or mRNA display, are employed for high-throughput screening of large peptide libraries to find new drug candidates. A major contribution is N-to C-direction synthesis and the use of "green" reaction media (such as frozen aqueous solutions or supercritical carbon dioxide) in enzymatic reactions.

By synthesis technology analysis

Why did the Solid-Phase Peptide Synthesis (SPPS) Segment Dominate the Market in 2024?

The solid-phase peptide synthesis (SPPS) segment held the largest share of the chemical synthesis peptide drugs market. Mainly, this technology is automation-friendly, versatile (non-natural AAs, modifications), scalable, and highly effective for complex sequences. The globe is putting efforts into the adoption of Sustainable Ultrasound-Assisted SPPS (SUS-SPPS), which critically lowers solvent usage (by 83–88%), reaction times, and washing steps by integrating multiple operations into a single step.

However, the hybrid phase peptide synthesis segment is predicted to expand fastest. The technology is merging SPPS (easy purification) with LPPS (scalability), to boost yield, purity, & cost-effectiveness for large-scale therapeutic peptides. Recently, Cambrex's API facility expanded in Waltham, Massachusetts, and CordenPharma's new peptide facility construction near Basel, Switzerland, to leverage peptide drug candidates, such as Viking Therapeutics' VK2735.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

By product type analysis

Which Product Type Led the Chemical Synthesis Peptide Drugs Market in 2024?

The reagents & consumables segment led with a dominant share of the market in 2024. The segment primarily comprises different resins, amino acids, solvents, and coupling agents to escalate effectiveness, sustainability, and scalability. Research activities in 2024 explored Oxyma-based reagents, such as COMU and PyOxim are preferred to raise efficiency and better solubility, as an option for HOBt/HOAt-based reagents.

On the other hand, the services segment is estimated to expand rapidly. Companies are facilitating custom synthesis, large-scale GMP-compliant production, and analytical testing. Also, they are promoting peptide modifications, including cyclization, PEGylation, lipidation, and the addition of fluorescent labels or D-amino acids. For the entire analysis, the market is implementing the use of mass spectrometry (LC-MS) and High-Performance Liquid Chromatography (HPLC) to ensure sequence, purity, and identity.

By end-user analysis

Why did the Pharmaceutical & Biotechnology Companies Segment Lead the Market in 2024?

The pharmaceutical & biotechnology companies segment captured a dominant share of the chemical synthesis peptide drugs market in 2024. These firms are stepping towards innovations in AI design, green chemistry (like solvent reduction), automation (BioDuro), and advanced delivery (Merck/Cyprumed). Furthermore, Novartis/PeptiDream are involved in the development of macrocyclic peptide discovery for radioligands.

However, the CDMOs/CROs segment is estimated to witness rapid expansion during 2025-2034. They are fostering their contribution in major capacity progressions, strategic alliances, and technological breakthroughs, to fulfil the raised demand for GLP-1 receptor agonists (like for diabetes and obesity treatments) and oncology therapies. Further spurring their facilities and affordability in peptide-drug conjugates (PDCs) and targeted therapies, like those comprising PSMA (prostate-specific membrane antigen) for prostate cancer diagnostics.

By application analysis

Which Application Dominated the Chemical Synthesis Peptide Drugs Market in 2024?

The therapeutics segment held the largest revenue share of the market in 2024. The globe is pushing the development of tumor-homing peptides, cell-penetrating peptides (CPPs), and innovative delivery systems (nanoparticles) for targeted cancer therapy. Many latest studies are demonstrating modular assembly, such as "LEGO-like" construction by integrating functional modules, including targeting, cell penetration for multifunctional drugs.

Furthermore, the diagnostics segment will witness the fastest expansion. The emergence of the latest peptide-based imaging agents, including $^{18}$F-PSMA-1007, is used for non-invasive and precise prostate cancer detection via PET scans. Also, includes $^{177}$Lu-FAP-2286, a theranostic agent in development and assisting in integrating an imaging function with targeted radiotherapy for solid tumors by binding to fibroblast activation protein (FAP). Whereas, PDCs, like SNG1005 (for brain metastases), are in Phase 3 and exploring high specificity and efficient tumor penetration as both diagnostic and therapeutic tools.

The Market Value Chain Analysis

R&D

The chemical synthesis peptide drugs market is exploring the discovery and design, subsequently synthesis (including protection, coupling, and purification), and finally, structural modification and activity evaluation.

Key Players: Aragen Life Sciences, Bachem, GenScript Biotech Corporation, etc.

Clinical Trials and Regulatory Approval

After the successful phases of clinical trials for the study of efficacy, toxicity, potency, and adverse effects, applications follow the approval process of both the FDA and EMA.

Key Players: Cardiff University, Instituto de Medicina Regenerativa, Egymedicalpedia, etc.

Patient Support & Services

Companies are facilitating different financial assistance, programs, and educational programs, whereas healthcare providers are supporting weight management in diabetic patients.

Key Players: Eli Lilly, Novartis, Merck & Co., etc.

Key Companies and Their contributions and offerings

- Novo Nordisk A/S- In September 2025, Novo Nordisk presented a paper introducing PepFuNN, an open-source Python package for in-silico analysis of peptides.

- Eli Lilly and Company- In October 2025, it announced positive Phase 3 results for its oral peptide, orforglipron.

- Sanofi S.A.- In July 2025, it fostered 82 clinical-stage projects, with wider emphasis on immunology and neurology, areas where peptide therapies are highly relevant.

- Pfizer Inc – In September 2025, it was focused on the cardiometabolic space, especially through its acquisition of Metsera.

- Novartis International AG- In May 2024, it accelerated its peptide discovery collaboration with Japanese biotech company PeptiDream.

Browse More Insights of Towards Healthcare:

The gene synthesis market size is anticipated to grow from USD 2.83 billion in 2025 to USD 10.89 billion by 2034, with a compound annual growth rate (CAGR) of 16.14% during the forecast period from 2025 to 2034.

The global DNA synthesis market size is calculated at US$ 4.62 billion in 2024, grew to US$ 5.43 billion in 2025, and is projected to reach around US$ 23.1 billion by 2034. The market is expanding at a CAGR of 17.42% between 2025 and 2034.

The gene synthesis service market was estimated at US$ 585 million in 2023 and is projected to grow to US$ 3138.64 million by 2034, rising at a compound annual growth rate (CAGR) of 16.5% from 2024 to 2034.

The global oligonucleotide synthesis market size is estimated at US$ 5.59 billion in 2024 and is projected to grow to US$ 20.31 billion by 2034, rising at a compound annual growth rate (CAGR) of 13.78% from 2024 to 2034.

The global healthcare data synthesis tools market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global nanoparticle synthesis system market size is calculated at US$ 0.7 billion in 2024, grew to US$ 0.78 billion in 2025, and is projected to reach around US$ 2.05 billion by 2034. The market is projected to expand at a CAGR of 11.34% between 2025 and 2034.

The global peptide synthesis market size is calculated at USD 686.59 million in 2024, grew to USD 774.06 million in 2025, and is projected to reach around USD 2277.59 million by 2034. The market is expanding at a CAGR of 12.74% between 2025 and 2034.

The global biosynthesis peptide drugs market size is estimated at US$ 18.31 billion in 2024, is projected to grow to US$ 19.45 billion in 2025, and is expected to reach around US$ 32.88 billion by 2034. The market is projected to expand at a CAGR of 6.26% between 2025 and 2034.

The global digital breast tomosynthesis market size is calculated at USD 3.03 billion in 2024, grew to USD 3.45 billion in 2025, and is projected to reach around USD 10.89 billion by 2034. The market is expanding at a CAGR of 13.63% between 2025 and 2034.

The peptide-based weight loss medication market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034.

Key Developments in the Chemical Synthesis Peptide Drugs Market

- In December 2025, Metropolis unveiled GLP-1 monitoring test packages to target the obesity market.

- In October 2025, Designs for Health launched Progenalen Pro Peptide, an advanced triple action solution for metabolic health and healthy ageing.

- In October 2025, ProImmune launched its ProVE SL Self-Loading MHC Class I Monomers, a new reagent platform developed to boost antigen-specific CD8+ T cell detection.

Chemical Synthesis Peptide Drugs Market Key Players Lists

- Takeda Pharmaceutical Company Limited

- AstraZeneca PLC

- Bristol-Myers Squibb (BMS)

- Merck & Co., Inc. (MSD)

- Amgen Inc.

- PolyPeptide Group

- Bachem AG

- Lonza Group Ltd.

- CordenPharma (part of Novacap/contract pharma group)

- AmbioPharm Inc.

- CPC Scientific / Chinese Peptide Company (CPC)

- ScinoPharm Taiwan Ltd.

- Peptide Institute, Inc.

- GenScript Biotech Corporation

- JPT Peptide Technologies GmbH.

Segments Covered in the Report

By Synthesis Method

- Chemical Synthesis

- Solid-Phase Peptide Synthesis (SPPS)

- Liquid-Phase Peptide Synthesis (LPPS)

- Hybrid Phase Synthesis

- Non-Chemical Synthesis

- Recombinant DNA Technology

- Group-Assisted Purification Peptide Synthesis (GAP-PS)

By Synthesis Technology

- Solid-Phase Peptide Synthesis (SPPS)

- Liquid-Phase Peptide Synthesis (LPPS)

- Hybrid Phase Peptide Synthesis

By Product Type

- Reagents & Consumables

- Amino Acids

- Coupling Reagents

- Equipment

- Peptide Synthesizers

- Automated Synthesizers

- Services

- Custom Peptide Synthesis

- Analytical Services

By End-User

- Pharmaceutical & Biotechnology Companies

- Pharmaceutical Companies

- Biotechnology Startups

- CDMOs/CROs

- Large CDMOs

- Mid-Sized CROs

By Application

- Therapeutics

- Cancer Therapeutics

- Diabetes Treatments

- Diagnostics

- Infectious Disease Diagnostics

- Cancer Biomarker Detection

- Research

- Neuroscience Research

- Immunology Studies

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6361

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.